Decoding the Black Box of Software R&D Spend

While GTM investments are closely monitored, R&D spending—which is typically the second-largest operating expense, eating up about 30% of revenue at software companies—can be more difficult to assess.

Measuring the productivity of sales and marketing efforts has long been a focus of software companies. Popular metrics such as magic number, payback period, net dollar retention (NDR) and customer acquisition cost (CAC) are often used to keep a close eye on go-to-market (GTM) investments. This is understandable, given that the average public software company allocates around 40% of its revenue to sales and marketing expenses.

However, while GTM investments are closely monitored, R&D spending—which is typically the second-largest operating expense, eating up about 30% of revenue at software companies—can be more difficult to assess. In fact, understanding the return on R&D investment is often seen as a complex and opaque challenge.

Below, we offer a five-step framework for companies to think this through, including advice around segmenting your R&D spending into specific buckets; evaluating ROI on multiple levels; and holding your whole team accountable for the success or failure of new investments—not just the engineering organization.

R&D is more important than ever in software

But first, some context. To be clear, software companies should invest in R&D! The software business model thrives on R&D-driven innovation, which fuels revenue growth and maintains a company’s competitive edge. As software delivery and consumption models have shifted from on-premise installations to the cloud, and from perpetual licenses to subscription or consumption-based pricing, vendor lock-in has weakened. Consequently, customers have become increasingly fickle in their software choices, making consistent product innovation and investment in R&D more crucial than ever. This trend is only intensifying with the rapid adoption of generative AI, which is heightening competition and reducing product stickiness across the software industry.

In today’s environment, this means constantly developing new products and features, while also maintaining and upgrading existing products. This is important not only to grow market share through new customer acquisition, but also to retain and expand the existing customer base. Effectively, as product stickiness has eroded, today’s software companies must convince customers to repurchase, subconsciously, their product every day.

Most companies will simply measure R&D spend as a percentage of revenue to benchmark themselves against peers, but that doesn’t reveal the efficiency or impact of the investment. Furthermore, looking at R&D as a percentage of revenue in isolation can be misleading. For example, high R&D spend as a percentage of revenue is not always bad, assuming the return on those dollars is high. A company that is going through a product transition or a big migration from on-prem to the cloud, for example, may have a high R&D percentage of revenue because they are investing ahead of revenue.

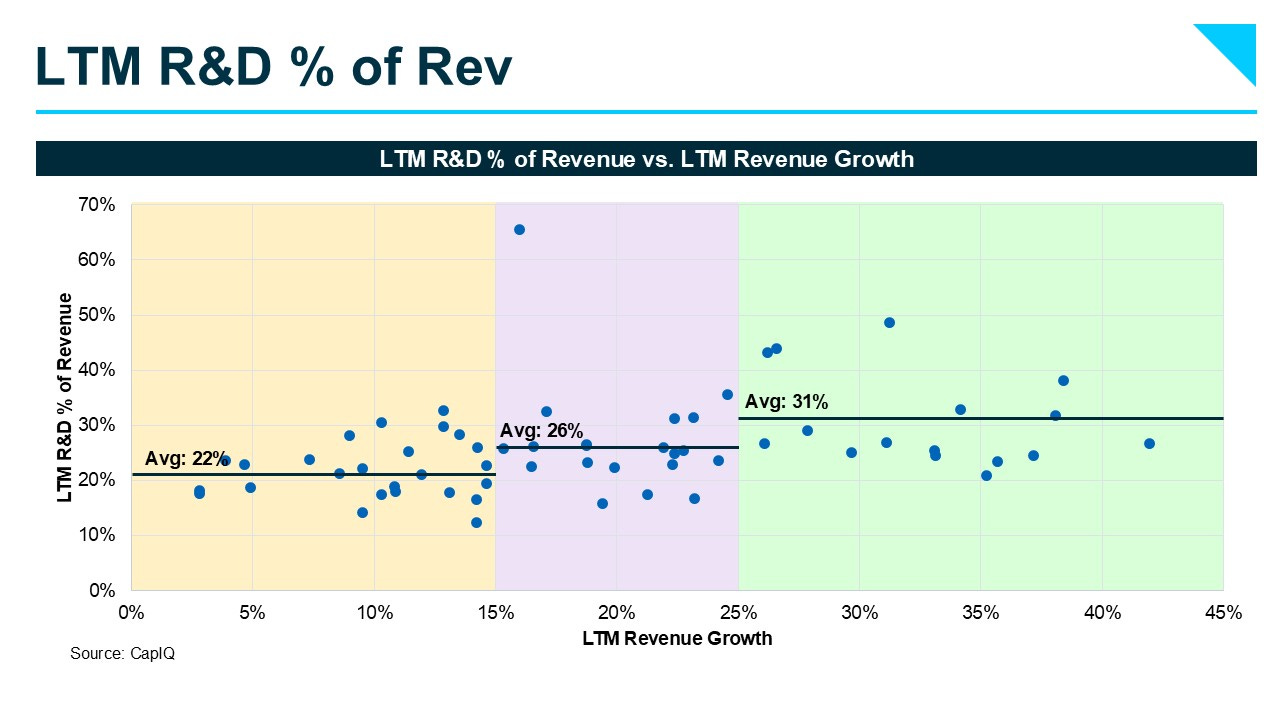

There are also other factors that may influence a company’s R&D spend rate, both external (i.e. macro) and internal (i.e. company goals). For example, as shown below, a company’s R&D percentage of sales will differ depending on where that company is on its growth journey. High-growth companies tend to spend more on R&D as they focus on innovation, while slower-growth companies tend to scale down R&D expenses as they push toward profitability and efficiency.

To help companies better allocate and measure R&D spend, we’ve devised the below five-step framework for decision-making. Admittedly, this is more qualitative than quantitative, but we hope it will provoke thoughtful conversation on how to better measure and allocate R&D spend.

Allocate top-down.

The first step is to decide how much money you want to invest into R&D. This decision should be rooted in data, taking into account business-specific objectives and context, as well as external data points, such as R&D spend comps (i.e. this is when it’s helpful to compare your R&D as a percentage of sales against your peers).

It’s important to note that while comparing your R&D spend to that of your competitors can help orient you, it is fine to spend more or less on a relative basis, depending on your goals. For example, rolling out a new product line or undertaking a heavy code-refactoring project may require more spending in a specific year.

Don’t think about R&D investment as a single lump sum. Instead, break it into granular buckets.

Once you have figured out how much money you want to spend on R&D in aggregate, consider splitting your R&D investment into four specific buckets:

R&D dollars to win more customers in your existing market;

R&D dollars to grow usage and revenue within your existing customer base;

R&D to expand your available market; and

R&D to retain your existing customers.

The first three buckets are meant to drive new revenue, while the last one is meant to protect your existing revenue base. Having more specific R&D buckets will allow you to better measure the success of that R&D spend based on whether you’re hitting your desired goal, and at what cost. Prioritize as needed, and where you will invest will change over time.

Listen to product-adjacent teams that are customer-facing.

The decision-making for R&D investments should not be constrained to just the product and engineering organizations. The end goal of all R&D investments is a better customer experience, and who better to provide insights into what customers want and need than customer-facing teams, including sales, marketing, customer success and support. Loop these teams into product discussions and leverage their expertise to allocate R&D dollars to building the products and features that map to customer needs.

Be deliberate about measuring the success of R&D projects.

Like any investment, it’s important to track the efficiency and effectiveness of R&D spending. To do this, we recommend evaluating ROI on both a macro and micro level.

At the macro level, it's crucial to align R&D investments with desired outcomes to measure ROI. For instance, the success of investing in new-product development should be assessed based on the new revenue generated by that product, and the allocation of engineering resources invested in code refactoring and modernization work should result in measurable churn protection. We also recommend companies track how go-to-market metrics are changing over time, to understand the impact of product investments. For example, is the average selling price for new products higher than existing products; are sales cycles getting shorter with new products and features in the mix; and are you winning more customers in existing markets than you were prior? Answers to these questions will help you understand how your R&D investments are perceived by customers and how to prioritize your investment efforts.

At the micro level, it’s important to measure the performance of the engineering organization. Essentially, is your team efficiently delivering high-quality product releases? Our portfolio company LinearB* outlines a framework for measuring developer productivity, including the below engineering benchmarks.

Hold the full team accountable.

Say your R&D investments aren’t yielding the desired ROI. While it can be easy to blame your engineering organization, R&D spending that doesn’t translate to tangible business value can signal deep-rooted, product-market-fit or GTM issues. For example, a low return on R&D spend may indicate that your product strategy isn’t resonating with your target market or that a misalignment between sales, marketing and product teams is preventing you from effectively capturing customer demand. We encourage companies to think about the performance of R&D spend as a leading indicator to identify and address gaps in product strategy, market positioning, GTM execution, or cross-functional collaboration, in addition to evaluating the performance of engineering teams.

In conclusion…

R&D is not just about spending money; it's about investing in the future of your company. By taking a more strategic and data-driven approach to R&D, you can ensure that your investments are paying off and driving sustainable growth.

The information contained in this market commentary is based solely on the opinions of Jason Mendel and Max Schireson, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as legal tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the authors.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements. Companies mentioned are for illustrative purposes only.

*Denotes a Battery portfolio company. For a full list of all Battery investments, click here.