AI Capex: Don’t Miss the Trees for the Forest

If you’re building new AI products, you’ve likely noticed the growing alarm among major financial institutions regarding AI capital expenditure (capex). Recently, influential players like Goldman Sachs and Barclays have raised red flags, suggesting that the current frenzy around AI investment might be leading us toward a bubble of epic proportions, eerily reminiscent of the late 1990s dot-com bust.

Goldman Sachs analyst Jim Covello put it bluntly: “Despite its hefty price tag, AI technology remains far from delivering real-world value. History shows us that overbuilding for a demand that doesn’t exist—or isn’t ready—leads to catastrophic outcomes.” This concern is not unfounded; the lack of meaningful returns on AI investments has been conspicuous. ChatGPT is a notable exception, but Barclays estimates that by 2026, AI capex will be high enough to support 12,000 ChatGPT-scale AI products.

We will likely see some overbuilding and overspending in AI, as it’s not uncommon to have overexuberance in hot new markets. But I believe the potential for realized return on investment remains strong. Similar concerns were raised about investment levels in internet infrastructure and cloud computing, yet those sectors went on to revolutionize the global economy. Of course, on the other hand, overinvestment in crypto and, earlier, cleantech, led to disillusionment and financial losses.

The critical question, therefore, is not whether we are overspending on AI, but whether we are building the right foundation for the future and if now is the time to lean into investment. In weighing recent headlines against my optimism for AI’s future, my mind keeps returning to an unusual history that may be familiar to my fellow music enthusiasts: the story of The Tree.

Harvesting “The Tree”

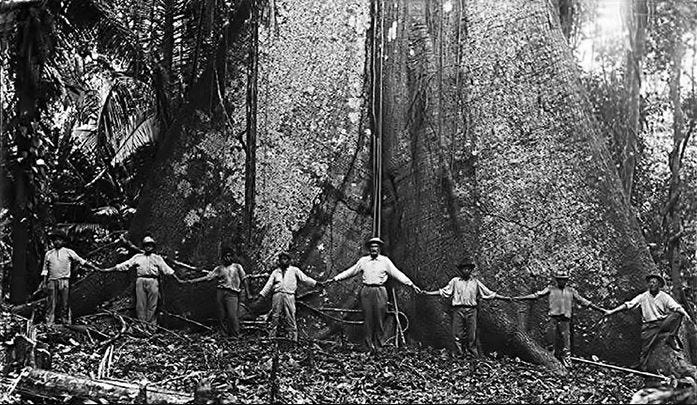

Back in 1965, a small group of loggers in the remote Chiquibul jungle, in what was then British Honduras, stumbled upon a towering mahogany tree – it stood over 100 feet high and was 12 feet in diameter at the base. Recognizing the value of The Tree’s wood, the loggers worked for days to saw it down. But when it fell, it landed deep in a ravine, where it was impossible to extract.

The Tree lay abandoned in the ravine for a decade, gaining an almost mythical status for its incredible size and value. Eventually, American wood importer Robert Novak heard its story. After years of searching for The Tree, bidding on its purchase and, eventually, working to extract it from the ravine, Novak had it cut into chunks and then lengths before shipping it to the United States.

At first, the wood attracted the attention of furniture makers and craftsmen who used it to build conference-room tables and cabinets for high-end buyers. However, many found the unique quilted mahogany difficult to work with.

It wasn’t until the late 1980s that luthiers, craftspeople who build or repair string instruments, first became interested in using The Tree’s wood to make guitars. When pioneering luthiers including Tom Ribbecke, Richard Hoover and Harvey Leach first handled the wood, they were struck by its beauty and unique sound. Compared to Brazilian rosewood, long the preferred material for guitar makers, the wood of The Tree was “like the very best rosewood, with this astonishing clarity and bass response.”

Today, very little of The Tree’s wood remains untouched and it commands a steep price, largely recognized as the superior source of guitar tonewood in the world.

From the moment loggers spotted The Tree, its potential was undeniable, yet its true value remained uncertain, requiring massive investment and effort to unlock—just like, I think, AI.

Like any metaphor, this may be tenuous. However, I believe it offers a valuable perspective to the criticism of the pace of AI build-up. It is clear to me that there is something special about this “tree.” AI’s most impactful applications are simply yet to be discovered, and it matters if you harvest them first.

Striking the Right Chord with Generative AI

Generative AI is already showing tangible benefits across various sectors, redefining how we approach tasks that once required human creativity, such as writing or coding. Tools like ChatGPT have revolutionized learning, acting as a personalized tutor that can adapt to individual needs, fundamentally altering how people acquire new knowledge. These early successes are impressive, and, in my view, they are just the opening act.

Professional forecasters have a track record of underestimating the pace of AI advancements. We are now entering the early stages of agentic AI—autonomous systems that can not only generate content but also take actions based on contextual understanding and long-term goals. This will radically transform industries such as legal and healthcare, where AI agents will soon handle intricate queries and interactions with unprecedented precision. Furthermore, the integration of multimodal AI, which processes and generates information across text, image, video and audio, will enable richer, more immersive interactions. The potential of voice modality, in particular, stands to create intuitive, conversational AI experiences that are as natural as speaking to a human.

Ultimately, discovering these breakout use cases first is critical. First-mover advantage can unlock one of the most significant advantages that AI companies can establish.

These advancements will reshape our economy and society in ways we are only beginning to fathom. Just as the true value of The Tree was only realized when its wood was used to create world-class guitars, the full potential of AI will be unveiled as we continue to craft this technology in new ways.

The information contained herein is based solely on the opinion of Brandon Gleklen and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the author.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.