'ZIRP' No More: A Founder Playbook for the Market Downturn

You’ll be hard-pressed to find a “nap pod” in a Silicon Valley tech-company office anytime soon.

Nap pods, NFTs, free workplace massages and other caricatures of big-tech life are now, more or less, relegated to the graveyard of ‘zero-interest-rate phenomena,’ or ZIRP — part of the broader industry right-sizing amid the market downturn.

Private-company leaders are noticing big-tech companies reaping the benefits of cost-cutting measures and also recognize the potential of generative-AI technologies to automate coding, sales, marketing and creative content, driving impactful results with a much-lower cost structure.

And how could they not? In board rooms, private company founders are often advised to do two things: Build great products and grow efficiently. Balancing those obligations with other leadership responsibilities can be difficult in the best of times, but it’s a particularly tall order in the midst of a potential recession, ongoing industry layoffs and slowing IT budgets.

Not to mention, for many private software companies, even highly-valued unicorns, there is a high bar to meet to transition to a successful IPO, including a 10x+ revenue ramp and strong margins, as we noted in our 2022 State of the OpenCloud report.

But I remain optimistic that many of these startups—particularly B2B software and infrastructure companies—can pull through and prosper in this new environment. Why? Namely, because software is a uniquely attractive asset class, as it drives increased productivity, replaces high-cost labor and can generate 80-90% gross margins.

Furthermore, software companies can scale quickly to massive revenues and can generate 30-40% operating margins at scale. Per Capital IQ, there are 16 US-based software companies with more than $1B in next-twelve-months revenue that went public in the last five years. This is unheard of in any other industry.

That said, the boom times over the past few years have, in my view, encouraged some bad habits in the technology industry and among many private software firms. Investors, company leaders and employees alike became accustomed to the promise of multi-billion-dollar software companies, minted at record pace. With this dogged focus on “growth at all costs,” we naturally saw incredibly high burn rates with steep investments of time and resources into sales, marketing and R&D with little oversight or accountability.

Many investors, myself included, were willing to endorse high cash-burn rates for early-stage companies hoping to reach 30-40% operating margins on billion-dollar revenue when it meant they’d be burning that cash for three to four years. That journey now looks like it’ll take closer to five or six years – the result of an IT spending slowdown and significantly-rising costs of capital – a stark, new reality. A high-burn approach is unsustainable under these circumstances, to say the least.

But there’s good news: You can reduce cash burn and succeed, even in the current environment. In fact, by becoming more cost-sensitive, you will likely be better off in the short- and long-term – we’ve seen it many times before.

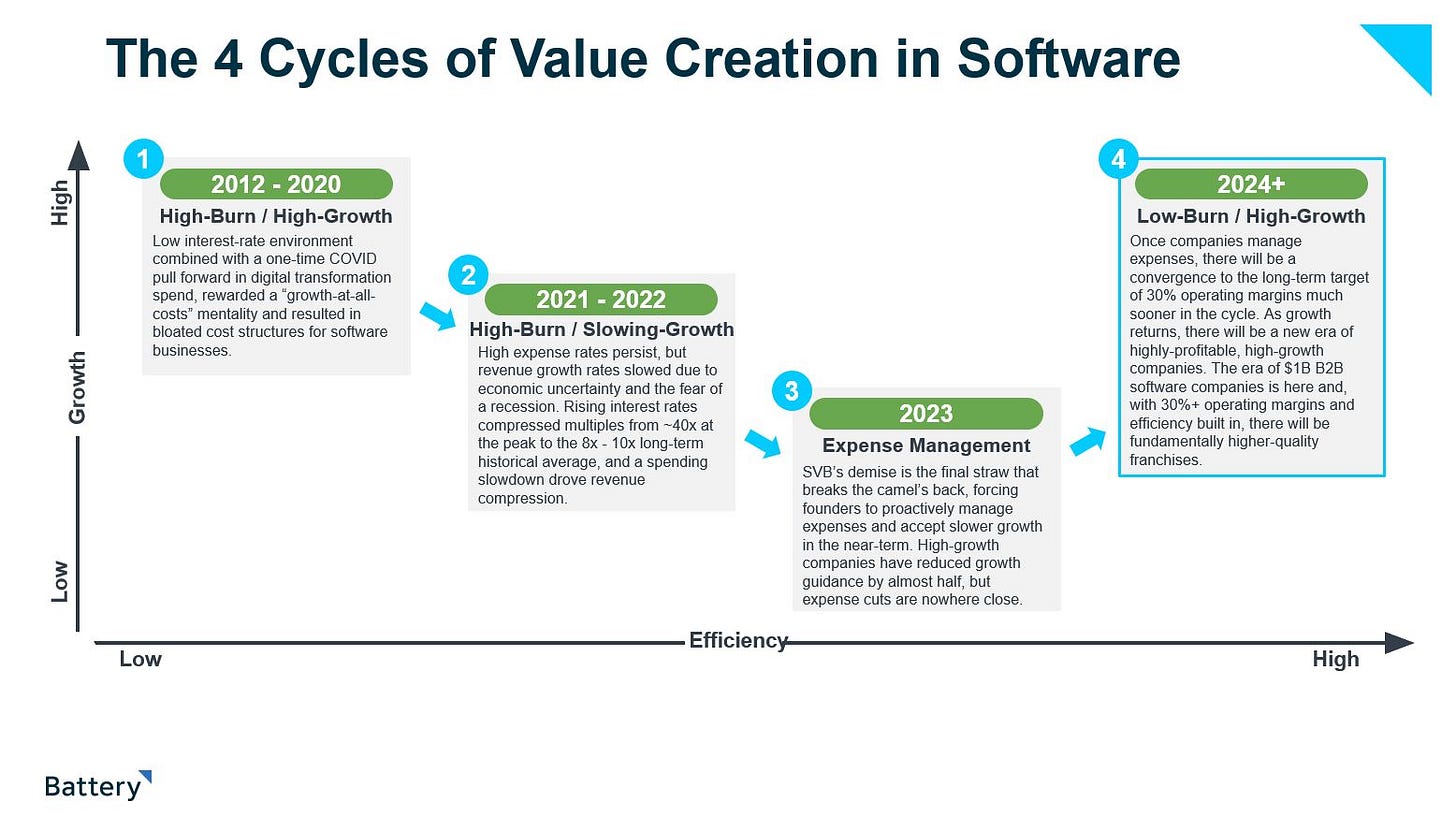

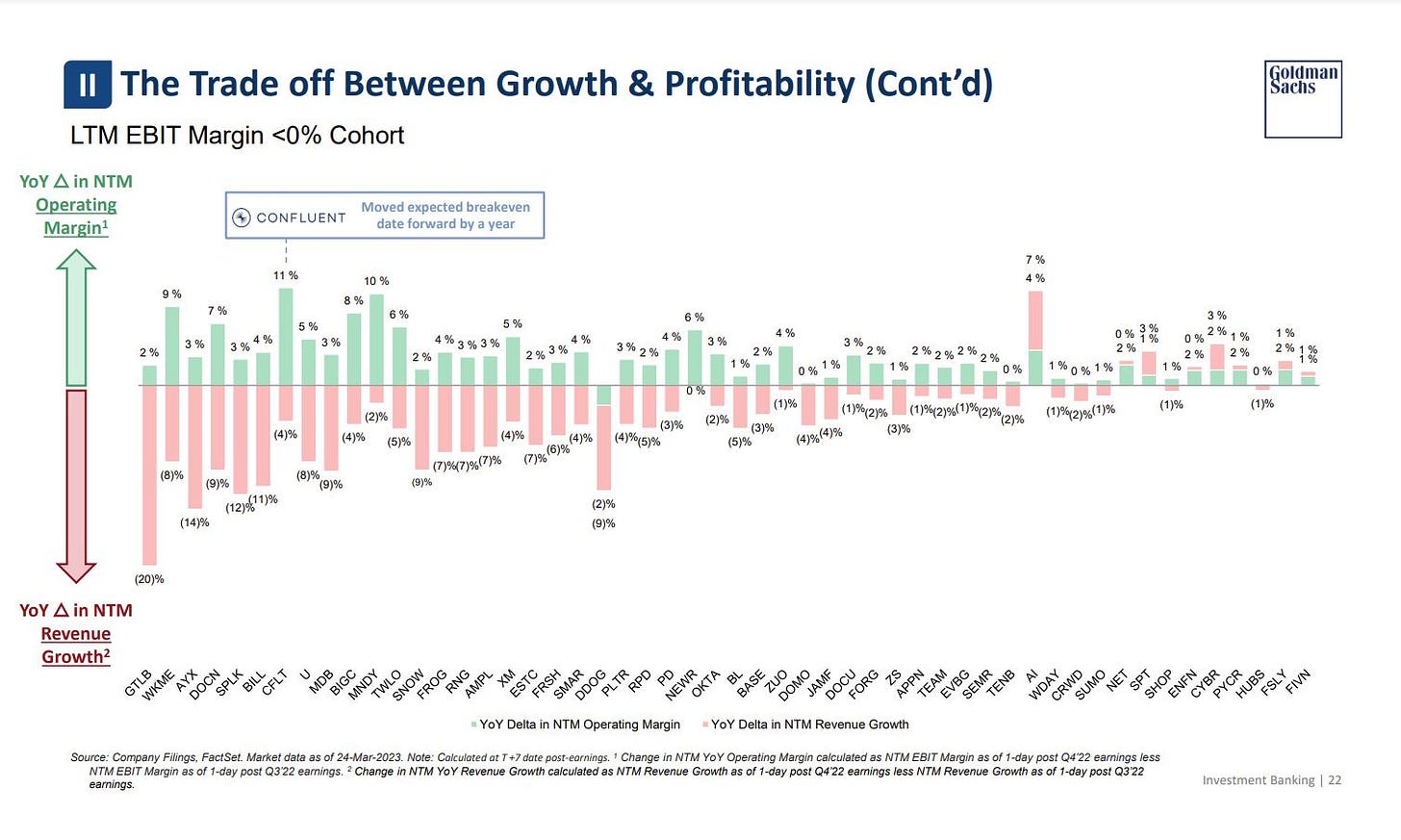

In fact, we tend to see four essential cycles of value creation in the software industry, illustrated below by our chart and by a March 2023 Goldman Sachs analysis of the trade-off between growth and profitability, which we now are seeing play out as companies come to grips with slowing growth and the need to manage expenses.

So, early-stage founders: This is a call to action. The golden era of software companies is ahead of us, despite the near-term belt tightening and recession fears. Take advantage of the opportunities ahead: your larger, more well-established peers and competitors certainly are. It’s time to accept the reality of today’s environment and turn on your efficient growth mode – because you should, and now you can!

Here’s what we suggest you consider:

Optimize your sales and marketing operation. Consider retooling compensation plans to focus not just on gross annual recurring revenue (ARR), but on net-new ARR – this will help to manage customer churn, since net-new only includes revenue from new customers and expansion deals after subtracting lost revenue from churn or downgrades.

Look closely at your ramp periods for new hires and find productive metrics early on to improve team operations, such as conversion rates, time to close and more. Your sales team should have 30-50% ramped capacity within a quarter or two of onboarding, with good pipeline coverage. Previous models of 12-month ramps with best-effort performance in the first year are unsustainable.

For consumption revenue companies: Be sure to emphasize to your team the importance of landing lower average selling price (ASP) deals in shorter sales cycles with enterprise logos. A 90-day land deal with a big bank, even for $100K, is certainly worthwhile since consumption can naturally grow driving 140%+ net dollar retention and high lifetime value. Grease the skids on your way in and watch it grow!

For seat-based revenue companies: Focus on deploying >90% of customers’ seats within 90 days of the purchase order. This will reduce churn and down-sell risk at renewal time and may also drive early expansion.

All of these adjustments can help you to drive the magic number over 0.7x and LTV/CAC of 3x+, while reducing overall sales and marketing spend. See more on the SaaS magic number here, if you’re unfamiliar with the metric.

Please note: This is most important for companies in the $5-50M revenue range where sales and marketing costs can ramp up quickly and need to be very carefully measured.

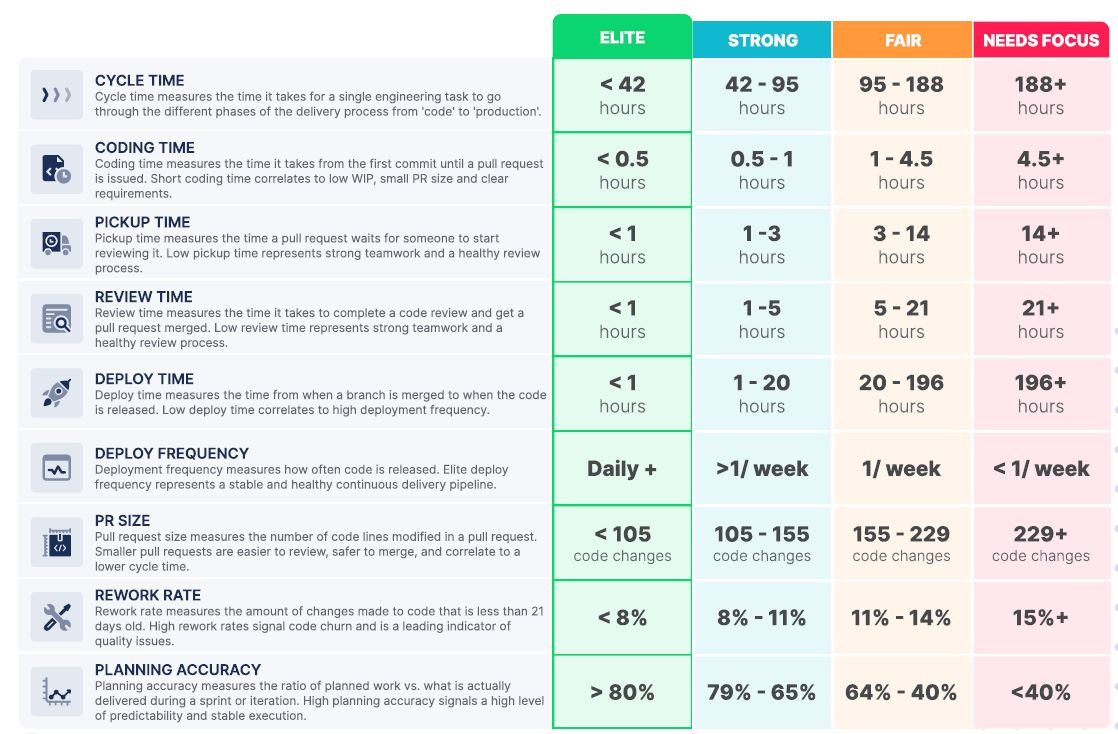

Improve your research and development oversight. The time and resources dedicated to R&D are still very high and not easily quantified. You can reduce development costs through tools like GitHub Copilot to auto-generate code or through open-source code proliferation.

Streamlining code output can drive higher productivity within your organization, as Battery portfolio company LinearB* recently explored. LinearB* published the below benchmarks from a study of ~2,000 dev teams to help engineering organizations quantify and compare their performance against industry standards and make the necessary changes to improve productivity.

Rein in general and administrative (G&A) expenses. Develop office expense benchmarks, manage finance and support headcount and find ways to build company culture and team bonding without breaking the bank. All too often, we see companies ignore the G&A cost bucket until it’s too late – but it is much easier to proactively manage expenses than it is to retroactively make cuts. As shown below, software businesses have a path toward managing G&A expenses to 10% of revenue over time and should benefit from economies of scale as top-line growth outpaces G&A spend growth.

Refresh equity and compensation benchmarking. Even though stock-based compensation is not a cash expense, it still impacts the company’s capital structure and should be tracked closely. To manage equity burn to 3-4% per year, structure compensation plans with the optimal cash/stock mix. In your equity burn calculations, account for the dilution from restricted stock units (RSUs) to be higher than the equivalent number of options since RSUs are issued without an exercise price. And finally, choose the appropriate compensation structure for stock-based compensation after 2022, as the 2021-era benchmarks are likely to increase equity burn significantly.

Yes, we are living in difficult times. But software is more important and relevant than ever in difficult times, driving productivity and reducing expenses for every industry. It’s about time we reduce the expense of building and scaling a software company by focusing on automation and best practices for your sales, research and administrative dollars. The sooner you reduce your dependence on venture dollars and focus on unit economics to have customer deployments fund your growth, the more sustainable your business will be in the long run.

Indeed, many of the biggest and most successful technology companies in existence today were built during market downturns, having developed a keen focus on unit economics and profitable growth from the start.

If you look beyond the market turbulence, you will see that it is truly an inspiring and motivating time to be working in the software industry. It is in these moments that the hungry, ingenious leaders of tomorrow are formed.

Will you be next?

* Denotes a past or current Battery company. For a full list of all Battery investments, please click here

This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The information and data are as of the publication date unless otherwise noted.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this post are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.