The AI Elephant in the Boardroom

It feels like I can’t go anywhere without hearing about AI these days, whether at home (kids using AI for homework) or work (AI is a hugely transformational opportunity that will change our world—so we should invest in it).

One particularly interesting AI talking point I’m hearing lately is coming from my fellow venture-capital investors. Some of them have recently speculated—somewhat boldly, if glibly—that technology companies’ public-stock performance today could be driven more by the companies’ mentions of AI, such as in press releases, earnings reports or other marketing material, than the typical “beat-and-raise” pattern of reporting earnings that are higher than analysts’ estimates, and then providing optimistic guidance for future performance. Professional investors and industry analysts follow these beat-and-raise patterns because, naturally, those disclosures can boost future stock prices. I should note, there is existing research behind this too, suggesting this is more than speculation.

This possible relationship piqued my interest. After all, many technology companies tried to publicly position themselves as Internet companies during the first dot-com boom, even if many of them weren’t really online-first businesses.

Similarly, about a decade-and-a-half ago, when the term “cloud computing” first gained traction, many tech companies scrambled to let the market know that they were really cloud companies—not trafficking in less sexy-sounding realms like “software as a service” or “distributed computing.”

The Wall Street Journal even ran a funny, front-page story in 2009 on this topic, noting that companies from Oracle to Microsoft to Salesforce were latching onto the cloud moniker, possibly for PR value. The story described a Salesforce conference in San Francisco at which the company hired people “wearing white puffy jackets and holding oversized cloud balloons” to stand outside. Inside the conference, which one panelist described as the “Woodstock of cloud computing,” attendees listened to a soundtrack including the Rolling Stones’ “Get Off Of My Cloud.”

More substantively, however, the article noted that in the first full fiscal year in which Salesforce started using the term cloud computing, its revenue increased 44%.

Could the same thing be happening today with AI?

AI Dominates Recent Earnings Conversations

As shown in the chart below, we reviewed each earnings-call transcript from the last eighteen months from the top 11 publicly traded software companies in the U.S. (by market capitalization: Apple, Microsoft, Alphabet, Oracle, Adobe, Salesforce, Intuit, IBM, ServiceNow, ADP and Palo Alto Networks) as well as Nvidia, an AI stalwart we used as a benchmark. This analysis sourced every mention of AI on those calls, from both company leadership and analysts: every talking point, question and response.

Nvidia, our benchmark, had the most AI mentions of any company included in the analysis, which is not surprising, given that the company’s chips are fueling much of the AI boom. But, interestingly, top publicly traded software companies (not including Nvidia) talked about AI five times as often in earnings calls between July and September 2023 than they did between January and March 2022. In the third quarter of this year alone, Alphabet, Salesforce and Palo Alto Networks collectively mentioned AI nearly 100 times in conversations between analysts and executives.

Of all the companies in the analysis, Salesforce (the cloud stalwart!) had the greatest increase between calls, largely from touting its Einstein and AI-CRM applications. Salesforce, of course, has very visibly doubled-down on AI in recent months, recently pledging to invest $500 million in generative-AI startups and publicly announcing a new collaboration with McKinsey to “accelerate the introduction of trusted generative AI for sales, marketing, commerce and service.” Anecdotally, in recent weeks, I’ve personally seen multiple ads for Salesforce’s generative-AI offerings on social media, search results and even the cover of the Wall Street Journal website. AI is clearly a major marketing priority for the company.

Similarly visible, however, has been the public pressure on Salesforce, from analysts and activist investors, for the company to deliver profitable growth, something most every big-tech leader has faced in recent months. This mandate is easier said than done, given ongoing market challenges like the pullback in some corporate-technology spending, increased demand for chips and, of course, ferocious market competition as every software giant rushes to adopt and integrate AI.

A skeptic might see Salesforce’s embrace of AI as a rebrand as the company is under pressure to deliver more robust profits. But a more positive—and, I would argue, intellectually curious—view is to see this pivot as reflective of a broader, forward-thinking alignment with market trends.

Indeed, Salesforce isn’t alone! AI mentions are up across the board as more tech leaders, public and private, seek to understand and implement the technology. The real question is: Is this wholly froth or is there something more substantive and transformational underway?

So, Do AI Mentions Affect Company Stock Prices?

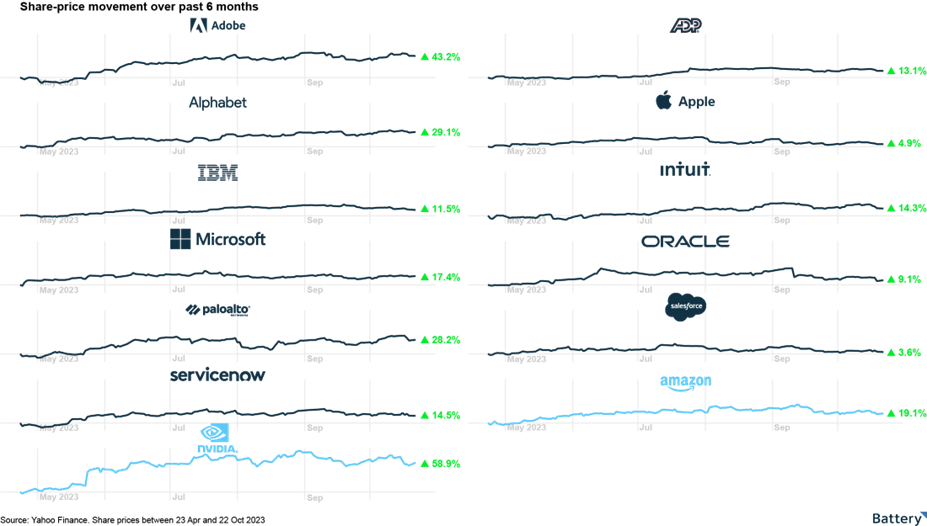

To that end, we reviewed the stock performance of each of the 11 companies included in our AI mentions analysis over the past six months, ending October 22, and added in our benchmark Nvidia and, for comparison’s sake, Amazon. Amazon, of course, very recently announced its $4 billion investment in artificial-intelligence startup Anthropic.

While we’re still very early in the AI revolution and seeing new and exciting technological progress emerge by the hour, we can see clear investor enthusiasm for AI here. There have been share-price jumps for every company included in the analysis, including Nvidia and Amazon, but also, notably, leaders in AI mentions like Salesforce and Alphabet.

It's also important to note that over 90% of Salesforce’s AI mentions since the start of 2022—18 months ago—have come in the last two quarters. At Microsoft and Alphabet, that figure is 69% and 55%, respectively. And over the last two earnings calls from the largest publicly traded software companies in the U.S., discussion of AI increased by 60%.

In their most recent earnings calls, both IBM and ServiceNow mentioned AI twice as often as in the previous quarter. At IBM, this was driven by discussion of the WatsonX platform and its recent acquisition of Apptio. And at ServiceNow, analysts were eager to hear how and when the new Lighthouse AI program would become available.

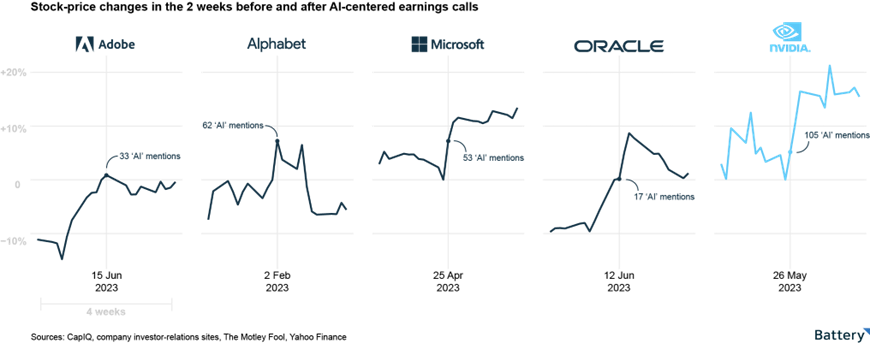

An even closer look at the weeks before and after AI-centered earnings calls—from different points in the past year—further suggests there may be a relationship between AI mentions and share-price performance.

AI is here to stay, in my view, and for most of the world’s largest and most prominent software companies, the technology is far more than window dressing. The biggest tech companies are dedicating an incredible level of focus on integrating AI not only into their existing products, but into their company roadmaps.

Conclusion

These upward share-price swings are happening for a reason, and I don’t think it’s new sales or market expansion generating investor enthusiasm. We are witnessing the fundamentals of company performance overshadowed by broad market enthusiasm for AI and its applications: a technological revolution on par with the dot-com boom.

I don’t have a crystal ball, but history repeats itself where there are market efficiencies. My prediction is that five to10 years from now, AI will be as ubiquitous as ‘the Internet’ in how we learn, work, travel, date, shop — everything.

And, speaking from the perspective of a venture investor focused on B2B software, I have every confidence AI is the way forward for building and growing software companies.

The information contained herein is based solely on the opinions of Dharmesh Thakker and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

The information and data are as of the publication date unless otherwise noted.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this post are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.