Let’s Talk About Repricing Stock Options

Here's one way to turn a short-term perceived negative for employees into a long-term net positive.

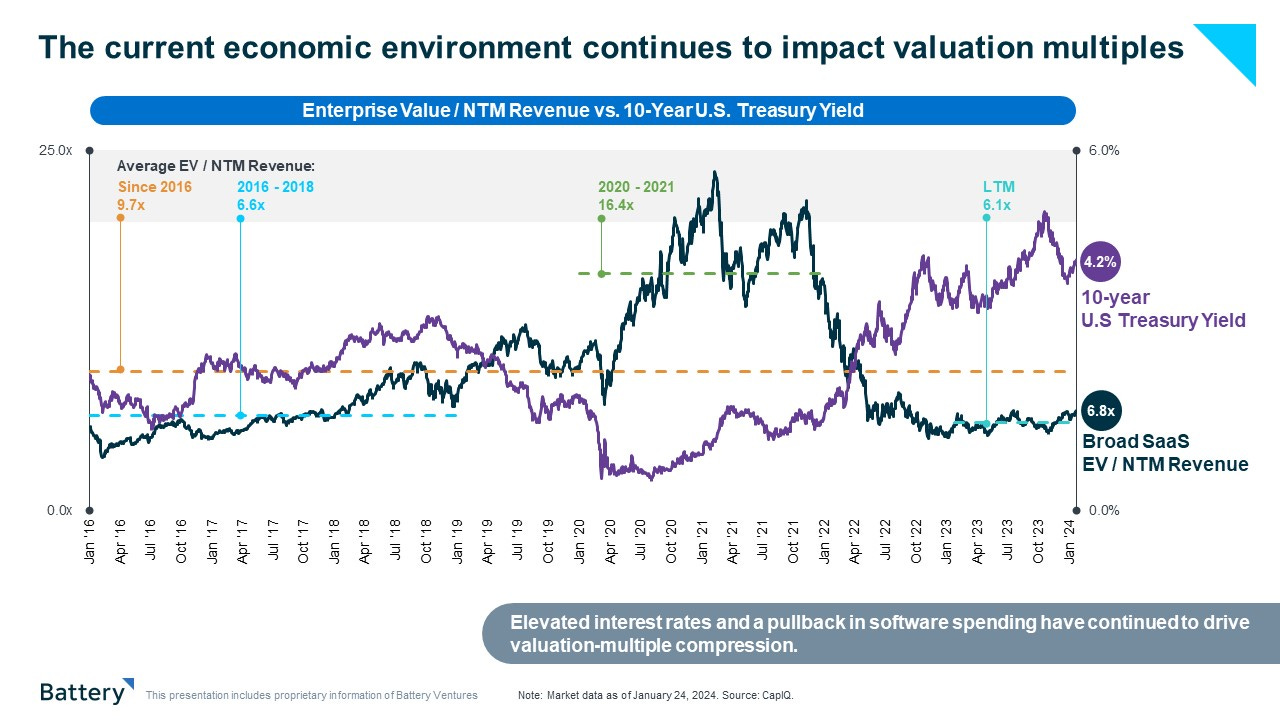

Let's face it: Gone are the heady days of skyrocketing valuations and easy growth for software companies. Instead, a new, more volatile reality has emerged, shaped by rising interest rates, economic uncertainty and geopolitical tensions.

While these forces have been distressing to many technology founders—and have forced operating adjustments for their companies—they also present a powerful opportunity to reignite the passion and commitment of your most valuable asset: your employees.

We’re talking about re-pricing employee stock options. It’s obviously a very sensitive topic, particularly since some employees will lose some value in their equity packages when valuations are reset. But in our view, private-company founders have to accept that macro factors have hurt tech valuations lately—it’s not all because of company-specific performance!—and view option repricing as a strategy to drive employee engagement. (Remember, public-company CEOs see their companies re-priced every day in the market.)

When done thoughtfully and transparently, option repricing is a tool that can realign incentives, boost employee morale, maintain top talent and lay a strong foundation for future growth—especially at companies with strong fundamentals in attractive markets where valuation has significantly outpaced commercial traction.

Let us explain.

For many companies, options granted in a bygone era, based on inflated valuations, now sit underwater, meaning the value of the options is lower than their strike price. Since options are normally a key component of compensation at tech startups, this situation can obviously demotivate your key talent and potentially drive them toward greener pastures (i.e. other companies, including your competitors—though many of those companies may be going through the same issues).

Re-pricing options, in various ways, is one way to try to mitigate the impact of underwater options, though it’s a strategy many tech CEOs may not be familiar with if they’ve only run companies in bull markets, when valuations keep going up.

But re-pricing is happening. In 2022, publicly traded Peloton repriced employee stock-option grants after the company’s share price fell 90% from its peak. The company had seen a huge runup in its share price during pandemic lockdowns when gyms closed and people turned to the company’s exercise machines to work out at home. But the stock sank when Peloton subsequently ran into problems, including supply-chain issues that delayed delivery of its bikes and a high-profile product recall. Then, of course, lockdowns eased, and people began returning to gyms.

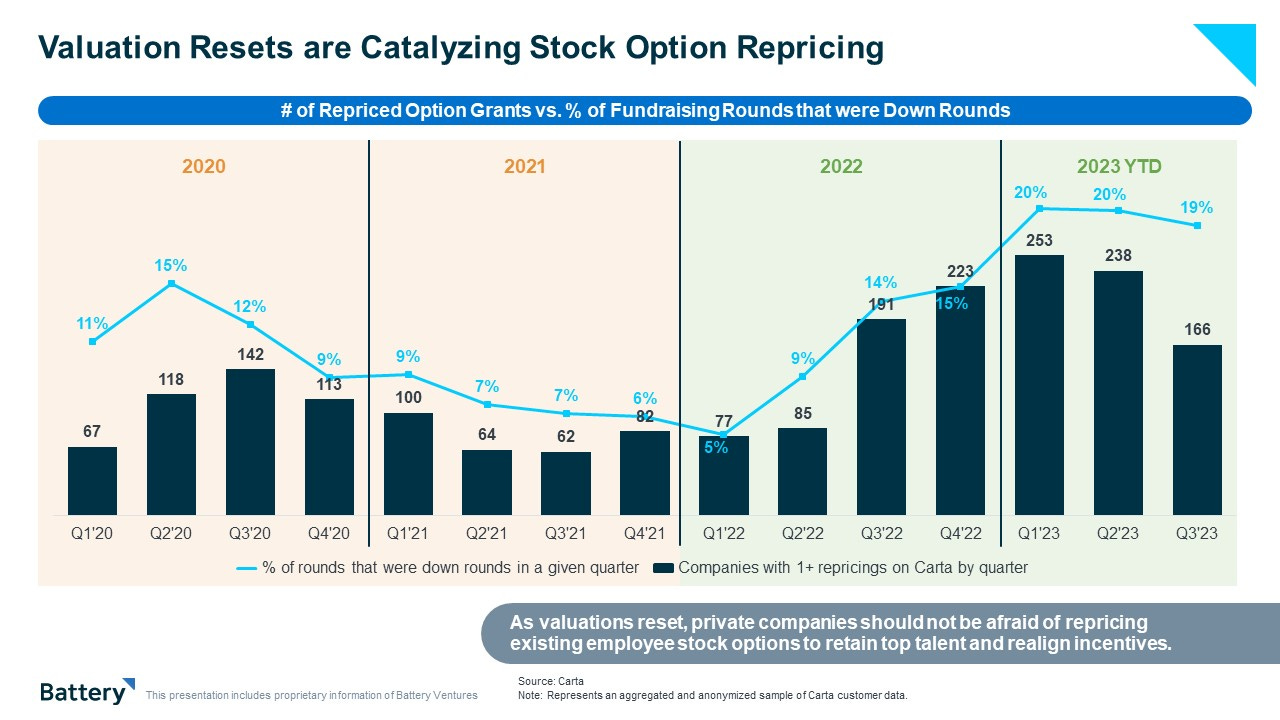

There is a broader precedent for stock-option repricing following economic corrections. According to a post on the Harvard Law School Forum on Corporate Governance, there was a surge in the number of option-repricing proposals after the 2008 financial crisis.

More private companies are also repricing option grants lately as valuations fall and down rounds become more common, according to data from Carta.* Other companies still sitting on large amounts of cash raised in the last several years are also repricing. They may not be facing an imminent down round to force a valuation change, but these companies realize the market wouldn’t value them as highly as they once were if they were to go out to raise new capital today. So, many are proactively adjusting the employee incentive structure instead of deferring the pain.

There are many different ways to approach re-pricing. Some key questions include whether companies should reprice all employee options, versus just options for executives, and whether they should focus only on unvested options—or consider repricing both vested and unvested options.

Every company is different, and there is no right or wrong answer here. On the executives vs. all-employees question, repricing options for everyone in a company means more dilution, even though it may be the more equitable thing to do. If you reprice only executives’ options, and these executives made management mistakes that hurt the value of the company—spending too wildly, hiring poorly or misreading the market—you could open yourself up to criticism that you’re letting them off the hook for the company’s problems. And this could be demotivational for the rest of your employees. Another wrinkle here is that newly hired executives will have a vastly lower strike price for their options than veteran execs, which can create a difficult, two-tiered compensation structure if the existing executives have been doing a good job.

When considering whether to reprice just unvested options or also those that have already vested, our advice is generally to focus on repricing unvested options, almost as if you are hiring a new employee. Employees that have a large pool of unvested options will vest their remaining shares at the lower strike price while employees at the end of their vesting schedule will benefit in their next cycle of refreshed stock options.

Finally, to execute the repricing, companies can adopt an option-exchange plan, through which employees trade in previously issued, underwater options for new options at today’s market value. Or companies can simply adjust (lower) the strike price of existing options.

However you choose to execute a repricing, remember, this is not just about numbers: It's about the trust and commitment that bind your workforce to your mission. Employees need to be reminded that a valuation reset in line with current market realities is not a sign of weakness, but a strategic move to:

Retain top talent: Underwater options breed discontent and fuel the temptation to jump ship. By repricing, you demonstrate your commitment to their long-term value and rekindle their excitement about the journey ahead.

Realign incentives: Options that were once aspirational rewards are now demotivational anchors. Repricing ensures incentives are tied to the company's actual performance in the current market, fostering ownership and driving alignment.

Attract new stars: In a competitive talent market, offering fairly priced options sends a powerful message. You're not just offering a job, you're inviting them to become partners in your success story.

Build trust and transparency: Repricing demonstrates your commitment to fairness and transparency, strengthening the bond between leadership and employees. This open communication fosters a culture of trust and mutual respect.

While impactful, repricing employee stock options requires careful consideration – determining eligibility, applying to vested or unvested shares, legal / tax implications and choosing the optimal method. But in today’s market, repricing is usually worth considering, even if your company hasn’t been forced to reckon with a dampened valuation because of a down round of financing.

Getting ahead of the issue can be a good idea. Most employees will know that the decacorn valuation you received three or four years ago has probably dipped quite a bit, possibly through no fault of company management. Being proactive can help build goodwill and trust with your employees and hopefully lay a foundation for future growth and success.

*Denotes a Battery portfolio company. For a full list of all Battery investments, please click here.

The information contained herein is based solely on the opinions of Dharmesh Thakker and Jason Mendel and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.