Launching Battery Ventures' Condensing the Cloud

Cloud-computing insights, from up and down the tech stack, brought to you by Battery Ventures.

When Battery Ventures was founded – 40 years ago this year – the B2B technology landscape looked very different than it does today.

For one, we didn’t have platforms like Substack to disseminate content to founders and company executives. In the pre-Netscape era there also weren’t any smartphones, online CRM systems or (of course!) advanced AI applications like ChatGPT to answer life’s tough questions and automate mundane business processes.

Most important, at least for our purposes here, is that cloud computing didn’t really exist 40 years ago.

Fast forward to today, and the cloud has become one of the most disruptive forces in tech, both in terms of software applications and underlying tech infrastructure, as we wrote in the 2022 State of the OpenCloud report. It’s also, of course, a technology underlying thousands of startups—startups with founders who are likely struggling to manage their companies today amidst a volatile macroeconomic environment and host of other challenges.

Given that volatility, and the fast-changing nature of cloud trends, we’re launching this “Condensing the Cloud” Substack to offer more consistent and timely thoughts on the cloud. Our writing in this channel will focus on broader cloud trends as well as the path ahead for cloud-business practitioners–with tactical market commentary, advice to founders and individual perspectives.

These viewpoints will be provided primarily by Battery general partners Dharmesh Thakker and Neeraj Agrawal, as well as Battery investors Brandon Gleklen and Danel Dayan, but also include contributions from many members of our global cloud-investing team.

But Why Now?

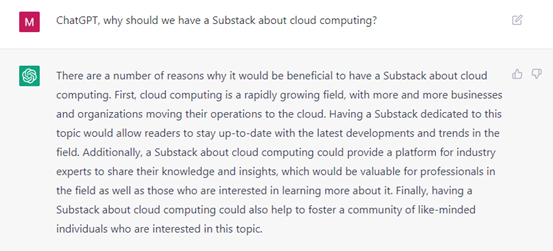

Well, we thought we would be remiss in not first asking ChatGPT why we should launch this Substack:

Well said! In addition, as you likely know: On-premise software is quickly becoming a corporate relic as organizations increasingly turn to cloud solutions instead. Meanwhile, the Big Three cloud providers – Amazon, Microsoft and Google, which serve as the platforms for so many cutting-edge tech startups today – are on track to hit a combined $200 billion in annualized revenue this year.

In January, Microsoft reported that revenue for its Azure unit was up 31% Y/Y (or 38% Y/Y on a constant currency basis) – surpassing expectations and demonstrating that a high-inflation, recessionary environment may accelerate the fortunes of cloud infrastructure leaders and companies that are indexed to these clouds, as we have previously predicted.

We’re clearly at another cloud inflection point. New innovations in data, fintech, generative AI, marketing tech, health-tech, cybersecurity and DevOps, among countless other sectors, built on the back of cloud providers, continue to unlock huge amounts of market value and offer incredible promise for the future.

But while the next chapter of the cloud-computing future will be transformational, it will not be easy.

Inflation, macroeconomic malaise and some of the lingering effects of the pandemic have transformed the B2B technology landscape and put intense pressure on cloud founders and startup CEOs. Gone are the days of “growth at all costs” and a surefire unicorn valuation.

Now, CEOs are being told to pursue “disciplined growth” – to control costs and get to break-even as quickly as possible. We should know: We’re some of the investors doling out this tough advice to companies.

But to be clear: we remain incredibly confident about the future of cloud computing, an optimism and fascination we hope to share with our subscribers moving forward.

To recap, we will endeavor to do two things with this Substack:

First, offer insights to help you make sense of new cloud technologies and trends, so you have a better sense of where these markets are headed and where the most promising opportunities lie.

Second, provide more practical advice for founders and other company-builders about how to navigate the tricky market environment today: how to raise capital, structure your workforce, think through comp plans, and deal with your board. Our experience backing dozens of cloud companies and advising their leaders—over two decades and through multiple market cycles—puts us in a unique position to do this.

Some of our upcoming posts will cover:

An overview on how we’ve been guiding our companies on 2023 planning and metrics that matter for Series A, B and C companies for founders;

What recent earnings can tell us about the macro and software-spending environment;

A deep dive into how 100+ CXOs are budgeting for developer, data and security spending in this environment; and

Anything else we find topical that we are usually sharing with our team and with portfolio CEOs that we think others would find interesting and valuable.

We’re excited to get started and hope you will join us on this journey to explore the impacts, the potential and the path forward for the cloud.

The information contained herein is based solely on the opinions of Battery Ventures and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes. The anecdotal examples throughout are intended for an audience of entrepreneurs in their attempt to build their businesses and not recommendations or endorsements of any particular business.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.