Consumption Pricing Models Are Here to Stay

Here’s how early-stage startups can leverage them.

MongoDB recently blew past analysts’ expectations with higher-than-expected first-quarter fiscal 2024 financial results and an upward revision of its full-year fiscal 2024 top-line and bottom-line guidance. These results garnered considerable interest in large part because they came as a surprise. In fact, just last quarter, the company had predicted a year-over-year growth slowdown amid ongoing economic uncertainty in its full-year fiscal 2024 guidance.

In the most-recent earnings report, MongoDB alluded to the rapidly growing market opportunity ahead as AI picks up steam, potentially leading to a new suite of intelligent applications and, ultimately, more data creation. But perhaps most interestingly, the company also reported 40% revenue growth for Atlas, its multi-cloud developer data platform — which is sold through a “consumption-based” pricing model — and the most net-new customer additions in two years.

How could so much change from one quarter to the next? The company’s consumption-based pricing model, combined with the current market conditions, may be the answer.

In recent years, much has been written about consumption-based pricing, through which vendors charge customers based on how much of a product they use, as a utility does. However, our basis for understanding the intricacies of consumption-based pricing models — the premise of much of this writing — was formed in a ten-year bull market. Needless to say, market dynamics have changed meaningfully in recent months.

MongoDB is not the only software company experiencing consumption unpredictability these days. Indeed, many others with consumption-based pricing models have issued less-rosy earnings reports in recent quarters. And where MongoDB has added new customers and workloads, its cloud-infrastructure peers are running into optimization headwinds. One might conclude that we are now seeing, for the first time, what happens when these valuable, yet sometimes more volatile, pricing models are put under stress.

In this post, we unpack the appeal of consumption-based pricing in light of the current, more challenging macro environment and offer some insight that may be beneficial to early-stage software companies who are considering implementing usage-based pricing.

So, what makes consumption-based pricing attractive? Let’s get back to basics.

First, there’s alignment of cost with value and go-to-market (GTM) motions, since customers only pay for what they use. This perfectly aligns the cost of the product or service with the value that is delivered. Consumption models also enable flexibility, allowing customers to quickly dial up or down usage as their own businesses evolve, which allows companies with consumption-based pricing to react more adeptly to changing market dynamics than their peers using subscription pricing.

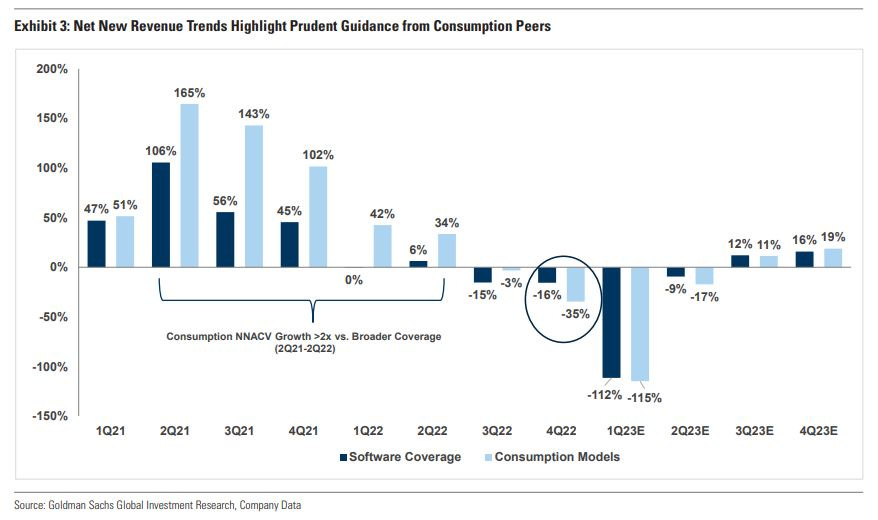

As shown in the chart below, relative to the broader software market, companies with consumption-based pricing were quicker to capture new software and digital-transformation spending during 2021. Conversely, these companies also saw a faster pullback in revenue growth during the current period of macro uncertainty, in which customers are slowing down spending and focusing on optimizing costs.

While this revenue-growth contraction is, indeed, short-term painful in today’s challenging economy, it is long-term healthy. Just as consumption flexibility enables customers to scale down usage in times of uncertainty, it also allows for faster recovery as software spending begins to bounce back.

It’s also important to note that consumption models are not bound by term-based renewal cycles — not capped by the number of users, features or term-based licenses — so the revenue of a software company with consumption-based pricing can truly scale in lockstep with the end customer’s business growth.

Second, consumption-based pricing enables healthy expansion rates, since a sales representative isn’t pushing customers to expand. It also reduces churn, allowing customers the flexibility to reduce usage in times of uncertainty, rather than churning off the product and services altogether. For companies with consumption-based pricing, the combination of healthy customer expansion and reduced churn results in healthier net retention, which is an important metric for growing companies as they scale and as expansion becomes a greater growth driver.

Finally, we see more durable customer growth for companies with consumption-based pricing, as customers can start small and aren’t locked into long-term contracts, which allows for predictable and consistent customer lands even in a tumultuous macro environment.

For a customer, predicting needs twelve months in the future is always challenging, but it is especially so in a challenging macroeconomic environment. Consumption business models provide the flexibility and low risk of ownership that customers want. To put it plainly, customers can easily exit or spend less if they’re not seeing value.

Consider MongoDB’s customer base. As illustrated by the chart below, the company has seen consistent growth in net customer additions in the last two-plus years. With a consumption-based pricing model, companies like MongoDB will be able to scale customer growth even in uncertain times; The customers the company adds today will seed growth in the future.

If you’re an early-stage company considering a consumption-based pricing model, here’s what to know:

Consumption-based pricing is, as we’ve said, a more-flexible model for customers and technology vendors. But with that flexibility comes uncertainty. It is important to recognize that many of the larger, more well-established companies with these models — including the likes of MongoDB, Snowflake, Confluent* and Datadog* — are still figuring out how to track, forecast and communicate consumption trends.

Don’t use annual recurring revenue (ARR) to measure consumption revenue.

Consumption revenue is recognized as the product is used or consumed and should not be extrapolated to reflect traditional term-based or seat-based software licenses that are billed either monthly or annually.

For example, say a customer, Megan, signs a non-contractual deal to consume $100K of software. In the first month, she consumes $10K of the software. The $10K of software Megan consumed would be reported as consumption revenue, but ARR would still reflect $100K. There will (almost always) be a lag between ARR and actual consumption revenue. Consumption tends to scale over time (i.e., Megan will consume the full $100K of software gradually over time), whereas ARR assumes the full value of consumption is occurring on Day 1.

Using ARR as an indicator for consumption-based revenue can be misleading. For that reason, most public companies with consumption-based models don’t report ARR, unless they need to provide cushion to manage growth expectations from investors or if they are navigating a transition from licenses revenue to consumption revenue.

Instead, consider the last twelve and next twelve months revenue, RPO and current RPO your key metrics.

Last twelve months and next twelve months revenue should be the primary metrics that consumption-based businesses track to measure growth and momentum — not ARR.

Pure consumption on a pay-as-you-go basis is difficult to forecast, so it is important to incentivize customers to sign up for minimum annual consumption agreements. This creates predictability while still preserving the benefits of a consumption model.

To show a higher degree of committed deals alongside consumption revenue, consider reporting remaining performance obligation (RPO) and current RPO. Many companies have found that by aligning investor expectations to company goals, they are able to better empower sales teams and drive improved performance.

Monitor gross margin closely.

For cloud-delivered software, closely monitor the gross margin and dial compute and storage capacity up and down to match customer consumption. Too much excess capacity will lead to a gross margin loss, while not enough can lead to outages and performance constraints during periods of high consumption. Consumption models don’t just align customer value, but also internal costs.

Optimizations will continue, so bake that into your forecast.

As the cloud matures, so, too will the sophistication of the enterprises that consume it. There is significant supporting data to suggest that spending optimization will continue to persist over time, if not on a regular basis.

As Snowflake CFO Michael P. Scarpelli explained on the company’s Q124 earnings call,

“I want to remind you, there's really 3 types of optimization. There's the optimizations by the cloud vendors, and that's with better hardware, better performance. Then there's the optimizations that we do regularly in our software, which improve performance and hence are cheaper for our customers. And generally, those two combined, we forecast that there's a 5% headwind every year to our revenue associated with those. And the third optimization is the one that we really saw in a few of our largest customers with them just wanting to really change their storage retention policies. Like one customer went from 5 to 3 years, and it's a massive petabytes and petabytes of data. And so, we lose that storage revenue. But on top of that, now your queries run quicker because you're querying less amounts of data.”

Expansion patterns in consumption models are strong in good times and bad.

Consumption revenue can be harder to forecast and be more volatile than subscription revenue. Be proactive about managing investor expectations and adjust the course of your business as customer consumption evolves.

In conclusion, there is significant opportunity at hand for software companies to employ consumption-based pricing. With the appropriate metrics and preparation, it can enable enterprising early-stage companies to sign up new customers, expand the scope of existing customers and create a more flexible, albeit unpredictable, business model.

The information contained herein is based solely on the opinions of Dharmesh Thakker, Danel Dayan and Jason Mendel and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes. The anecdotal examples throughout are intended for an audience of entrepreneurs in their attempt to build their businesses and not recommendations or endorsements of any particular business.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

*Denotes a Battery portfolio company. For a full list of all Battery investments, please click here.