Breaking Down the Latest Battery Ventures Cloud Software Spending Report

Reports of the death of enterprise tech spending have been greatly exaggerated, as we wrote for the Battery blog.

When we published the results from our inaugural State of Cloud Software Spending survey in September 2022, so much was in flux: We were tracking ongoing supply-chain challenges, macroeconomic and global uncertainty, workforce shifts and increased pressure on the C-suite to reach profitability.

In spite of those headwinds, the September 2022 survey findings came as a pleasant reminder that tech budgets can remain resilient in times of uncertainty: At that time, enterprise tech demand was relatively inelastic, and buyers were prepared to spend more dollars in 2023 than ever before.

However, as we have seen in the past months — and so acutely in recent weeks — these headwinds have persisted. Needless to say, if anyone was hoping for a respite in 2023 from market turbulence and unpredictability, it certainly hasn’t come yet. As software industry investors, we are optimistic by nature about the future of technology — but even we will admit that optimism has taken a bruising.

Of course, while we’re optimistic by nature, we’re also innately curious. In the spirit of that curiosity, we decided it was time to conduct the second State of Cloud Software Spending Survey, polling 100 enterprise-tech buyers representing over $30 billion in annual budget spend to update and build on findings from our first report.

TL;DR, even amid the challenges the tech industry continues to navigate, the Q1 2023 survey results should come as good news for enterprise-tech startups.

We’ll break down the key findings from the report below. If you’d like to see the full report, please click the image below or visit this link: Reports of the Death of Enterprise Tech Spending Have Been Greatly Exaggerated: The March 2023 Battery Ventures State of Cloud Software Spending Report

Let’s start with the key takeaways.

Contrary to what one might expect, the vast majority — 73% — of our survey respondents expect their enterprise tech budgets to stay flat or increase in 2023. Among respondents whose budgets are shrinking in the coming year, renewals are the main driver of those reductions. For founders, this means your sales teams should aggressively focus on understanding customer health, utilization and value entering the contract-renewal cycle. Having those insights early is key to maintaining customer relationships and ARR retention.

In terms of new business generation, there is still opportunity at hand: 65% of survey respondents whose budgets are increasing plan to dedicate those dollars to experimental budgets. Adoption of new technologies is still happening within the enterprise, but sellers should reset expectations on approval times for those contracts — things will move more slowly in today’s environment.

To be clear, organizations will take a closer look at their bottom lines in the next couple of months, even if they’re increasing their overall tech budget.

Now, let’s talk about buyer budget cuts. Among the survey respondents who are reducing their 2023 budgets, most will do so through vendor consolidation first, then by optimizing SaaS licensing.

If you’re a founder, take a look at your customers’ growth rates. If your customers are exhibiting slowing growth, get ahead of any potential problems with renewal by pushing sales and customer-service outreach as soon as you can. Make no mistake, the month of renewal is most likely too late to shift customer sentiment if your customer has already flagged ending your contract to cut costs.

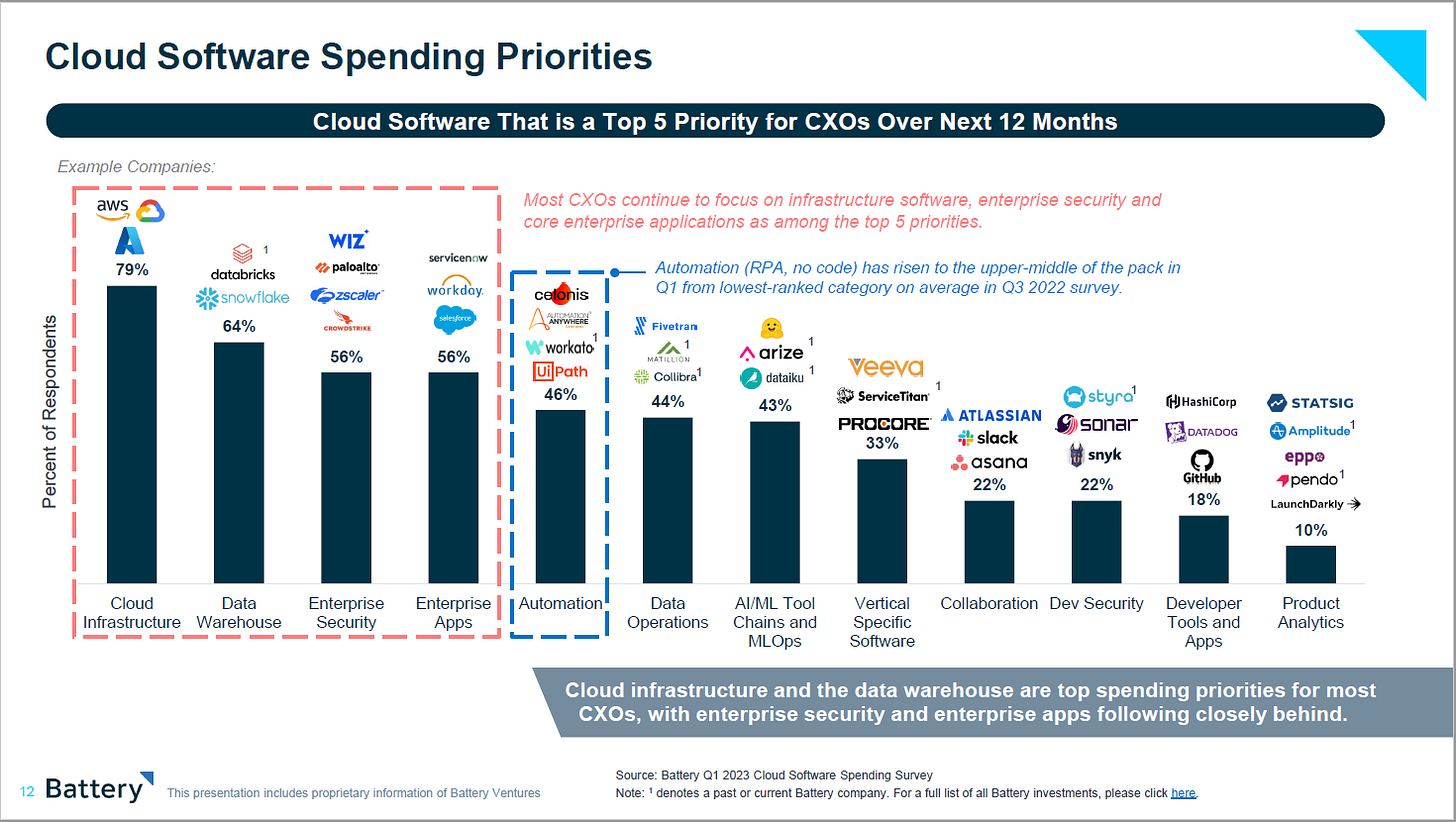

Shifting focus to condensing the cloud findings from our survey, there is a lot of good news to unpack. As Battery General Partner Dharmesh Thakker wrote about our 2022 State of the OpenCloud report, “software has already eaten the tech-forward world, but there’s more on the menu.”

During our recent Battery Executive Innovation Retreat in California, a chief data officer at a large healthcare company mused about the depth and breadth of that menu, joking that “giving Snowflake or Databricks* to a data scientist is like giving a 16-year-old the keys to a Ferrari.”

All jokes aside, there is no doubting the value and potential of the cloud as more companies become data-centric. Every company is now a tech company. Over the last five years, adoption of many of these cloud solutions has expanded rapidly, with significant room to grow (and increased demand from large enterprise tech buyers.)

The majority of these buyers have implemented or are expecting to adopt cloud cost optimization solutions, with a focus on observability, governance and job optimization, according to the most-recent survey.

With that said, these buyers are exercising much more oversight than in the past few years. Founders and sales teams must understand how to sell beyond the product itself, ensuring that customers know how to implement and optimize for the long run. Although consumption overages might look great in a quarter, that may create untenable challenges in retaining ARR and building a resilient business.

In conclusion…

Founders, take heart. There is a lot of opportunity in today’s market. With the right mindset and go-to-market strategy, you can see meaningful growth.

Here’s what we suggest you consider:

Pursue a deep understanding of your ideal customer profile (ICP) and your product value preparation. Know this landscape better than your competitors do.

Evaluate cloud solution provider (CSP) marketplaces. Please note: These aren’t “build it and they will come” solutions to sales generation, but they can be a helpful enhancement to your GTM motion. Meaningful amounts of spending move through these marketplaces.

Watch the KPIs that help you to understand GTM beyond pipeline, including: ARR per employee, or APE; SQL; cycle time and more.

Don’t wait for bottoms-up and PLG sales motions to save you in this market. These motions should be part of, not all of, your sales strategy, given the conservative nature of buyers in today’s market.

Take advantage of the available talent on the market: tech layoffs open opportunities. However, be disciplined in your hiring strategy. Sustainable organizational growth and a healthy company culture will come through smart, measured hiring.

Understand and adapt to the nuances in enterprise buying behavior. Not all industries behave the same, and there is a notable difference in buying trends between smaller enterprises and those with $500M+ budgets.

* Denotes a past or current Battery company. For a full list of all Battery investments, please click here

This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The information and data are as of the publication date unless otherwise noted.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this post are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

Thank you for sharing this report! Would love to work with y'all on some content around cloud cost optimization. Will reach out!

What an awesome summary of the reality all companies live in. These challenges are exactly what we at StackGuardian are addressing every day for our customers saving them a lot of hassle and cost.