AI Finally Gets Top Billing in the Battery Ventures Tech Spending Report

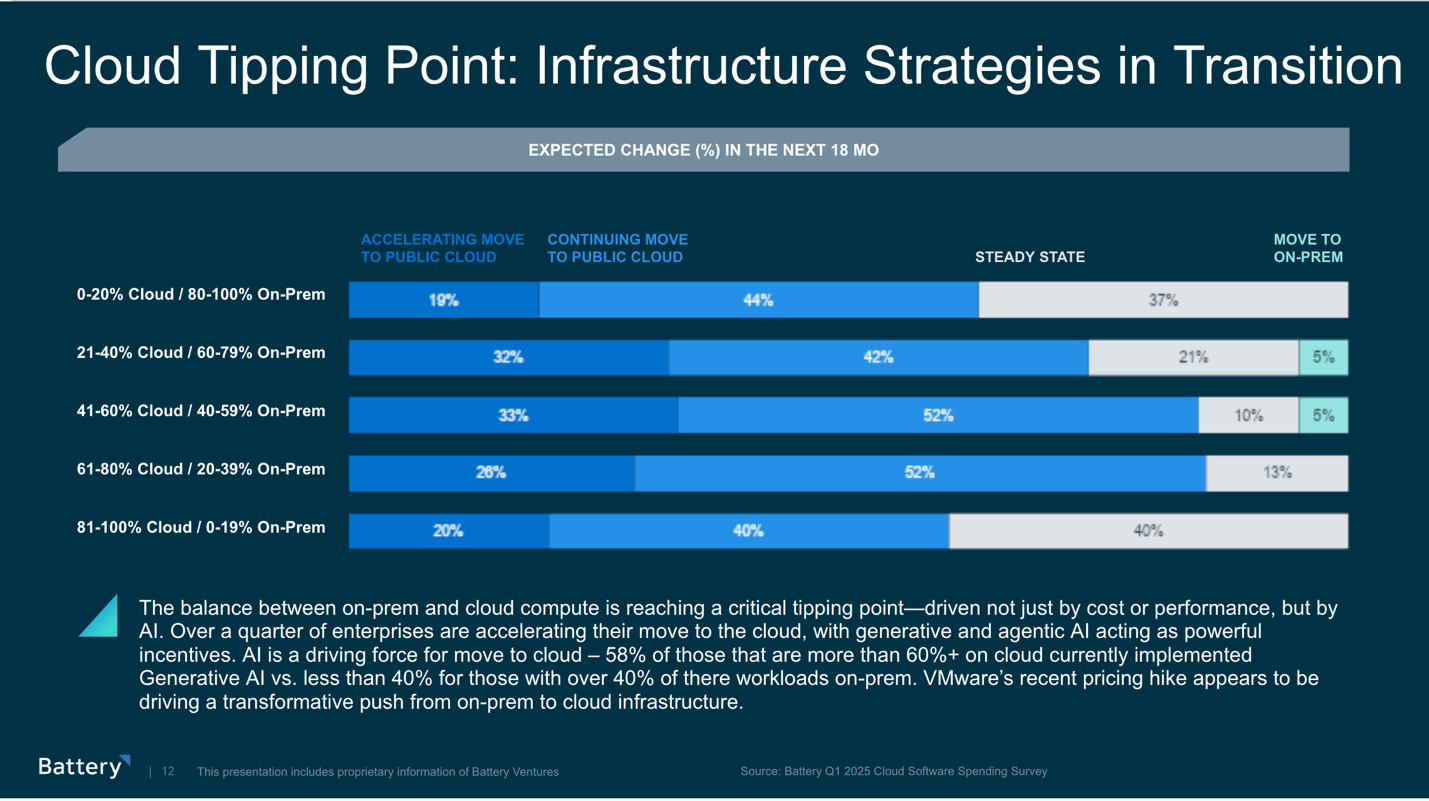

All eyes are on the cloud. According to our most recent State of Enterprise Tech Spending report, companies have reached a tipping point in planned cloud infrastructure investments, with 73% of CXOs reporting their organization is accelerating or continuing their cloud migration. However, they’re not investing in cloud for cloud’s sake, but to enable their new top spending priority: AI.

Just last year, the Battery Ventures spending report showed slower-than-expected AI rollouts, but the tide finally seems to be turning. For the first time, enterprise CXOs reported in Q1 2025 that Generative AI and LLMs were their top spending priority for the next 12 months. With dramatic rises in identified use cases and GenAI demand across the enterprise, it’s clear that organizations are moving beyond dipping a toe into AI.

To glean these insights, we surveyed 100 CXOs who collectively represent over $35 billion in annual technology spending. Our goal was, as always, to gauge the budget planning and overall sentiment of large enterprise technology buyers. Below, we’ll dig into some of the other key takeaways from this year’s report, which reveal some fresh opportunities for early-stage technology startups. If you’d like to see the full report, please click the image below or visit this link: Survey Says: Tech Spending Slows Slightly, AI Tops CXO Priority List

Note: We conducted the survey in late March 2025, prior to the Trump administration’s tariff announcement on April 2. While the subsequent market volatility may impact buyer sentiment score—particularly in sectors with greater exposure to tariffs—most enterprise IT budgets aren’t subject to major revisions due to macroeconomic factors. In some categories, IT spending may be actually accelerated by such forces—for instance, investments in AI or cloud for modernization and reducing risk to future development. The technology sector’s tariff risk is also not yet known.

Let’s start with the key takeaways. Cloud migration is accelerating. Enterprises are modernizing infrastructure, creating new opportunities for AI-driven innovation and agile operations. While 54% of enterprises still run most of their compute on-premise, momentum is shifting fast. With 73% accelerating or continuing their move to public cloud, the opportunity for cloud technology providers is expanding rapidly.

Cloud has reached a tipping point. VMware’s recent pricing hike appears to be driving a once-in-a-generation push from on-prem to cloud infrastructure.

Enterprises are refreshing core systems like ITSM, ERP, and CRM systems. This major move will help companies gain next-gen functionality like AI and automation. In good news for software vendors, enterprises are largely looking to new software players to meet those needs.

Spending priorities are changing. Generative AI and LLMs have overtaken cloud infrastructure as the #1 priority for CXOs.

AI use cases explode. Production AI use cases more than tripled since our last survey, jumping from 5.5% to 16%. Similarly, the agentic AI wave is building: 46% of enterprises are either actively deploying or in R&D for agentic AI.

Early shifts are underway in security information and event management (SIEM). Other trends the survey revealed include a nascent trend towards decoupling SIEM and shifting to more modular security architectures.

To catch up on previous reports, check out what we published in March 2023, September 2023, April 2024 and September 2024. Check out this year’s full report here to learn more!

The information contained herein is based solely on the opinions of Scott Goering and Evan Witte, and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the authors.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this publication are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.