5 Key Takeaways on the Current State of Generative AI in the Enterprise

There’s a huge amount of buzz (and hype) about generative AI right now. And when it comes to enterprises, the buzz is understandable.

From Jamie Dimon, JPMorgan Chase CEO, saying that AI will bring about a three-and-a-half-day work week, to recent studies suggesting that as much as 40% of today’s work can be automated, the potential social impact—and productivity boost—of AI is incredible. If you read the headlines, you might think the robot revolution is already here and workers can finally focus on the office fantasy-football league.

Many widely available AI tools exist already to perform simple tasks with low-sensitivity data and non-life-altering outcomes, such as summarizing a conversation with a coworker. But how quickly are enterprises moving towards trusting AI with more mission-critical tasks?

From our latest survey of enterprise tech buyers on what they are (and aren’t!) spending money on, we can draw some conclusions about where the generative-AI market is right now, supplemented with what we’re hearing directly from buyers in our network.

Here are five key takeaways:

1. The AI market is just starting to take off…

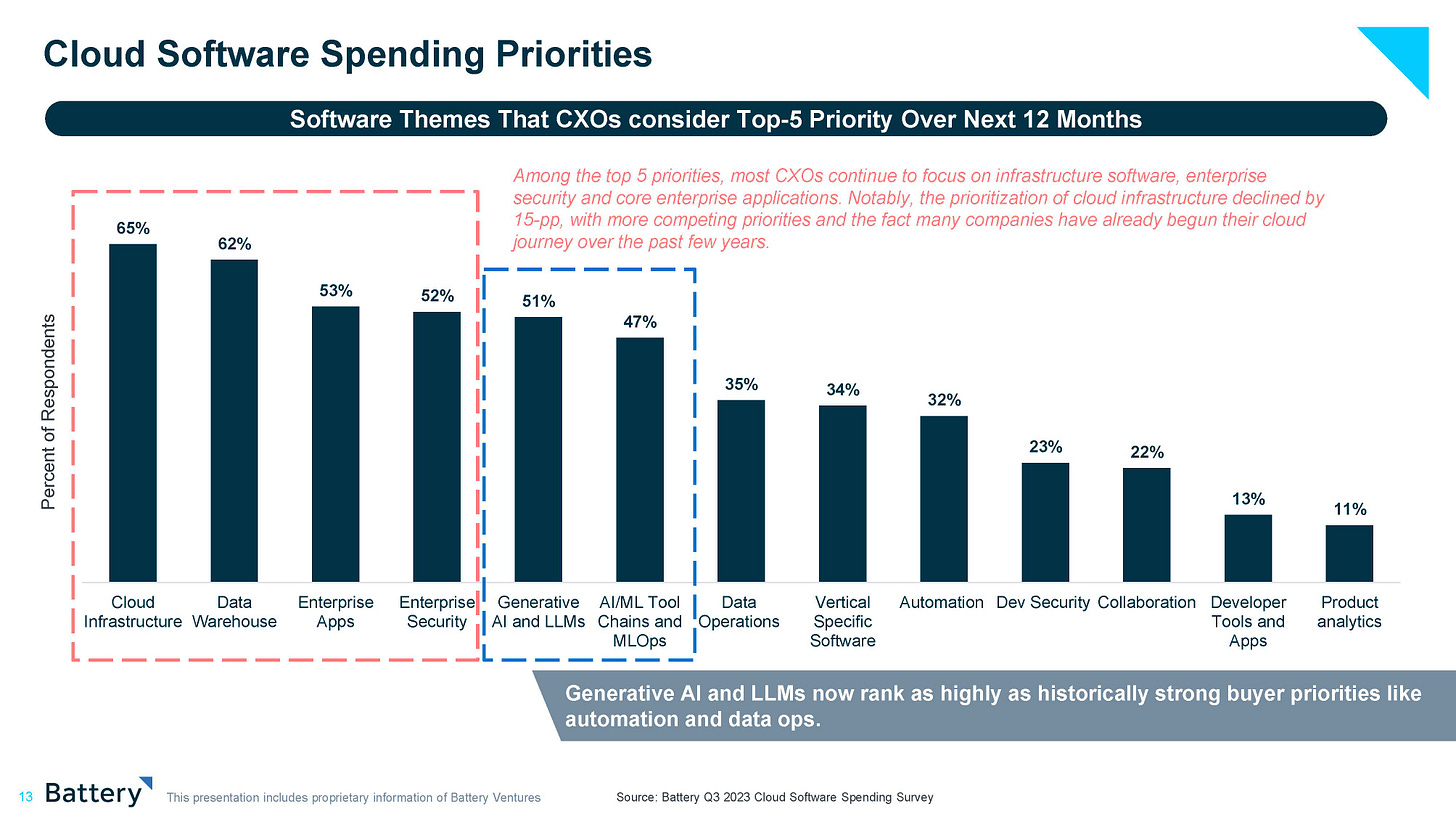

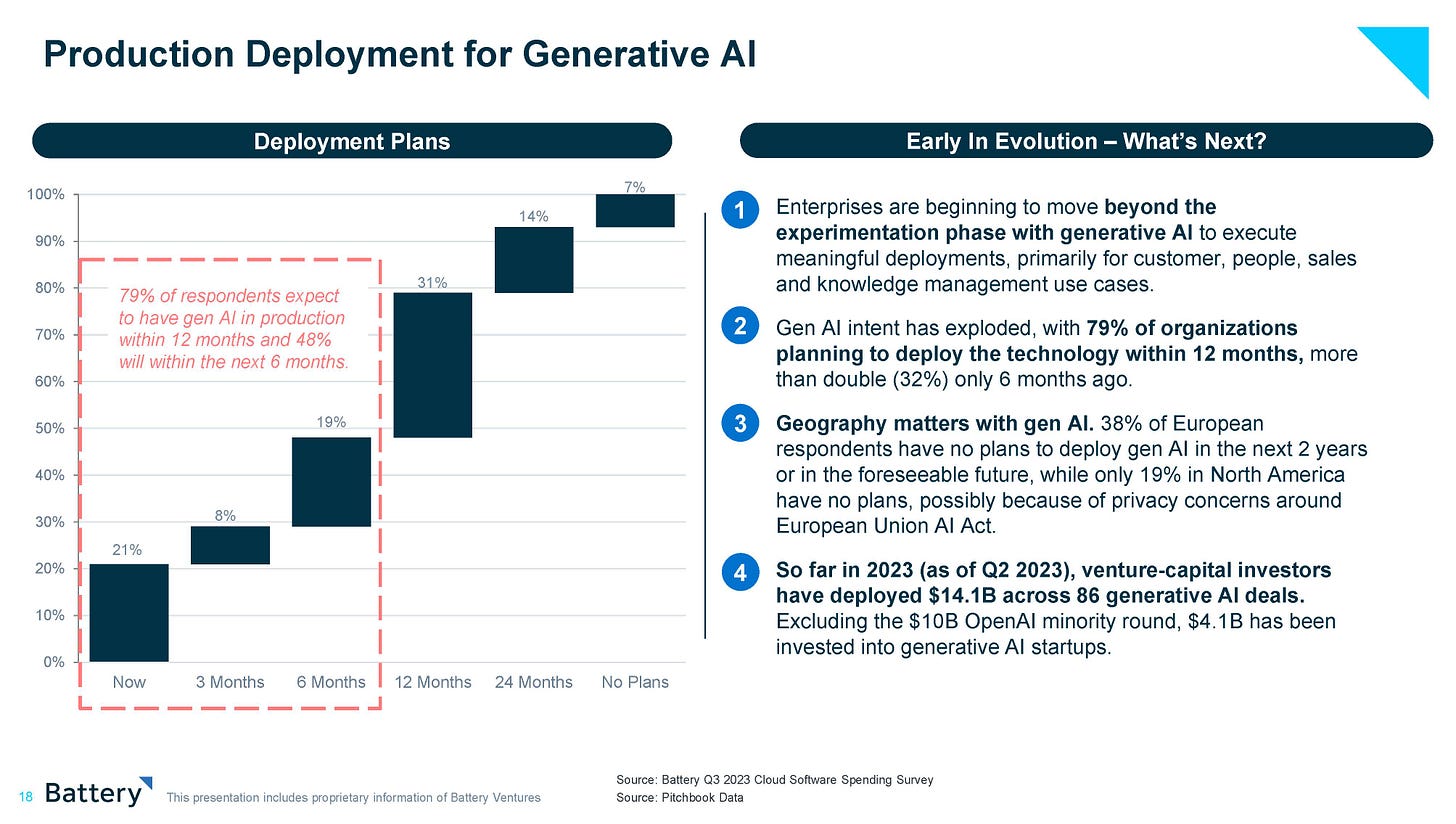

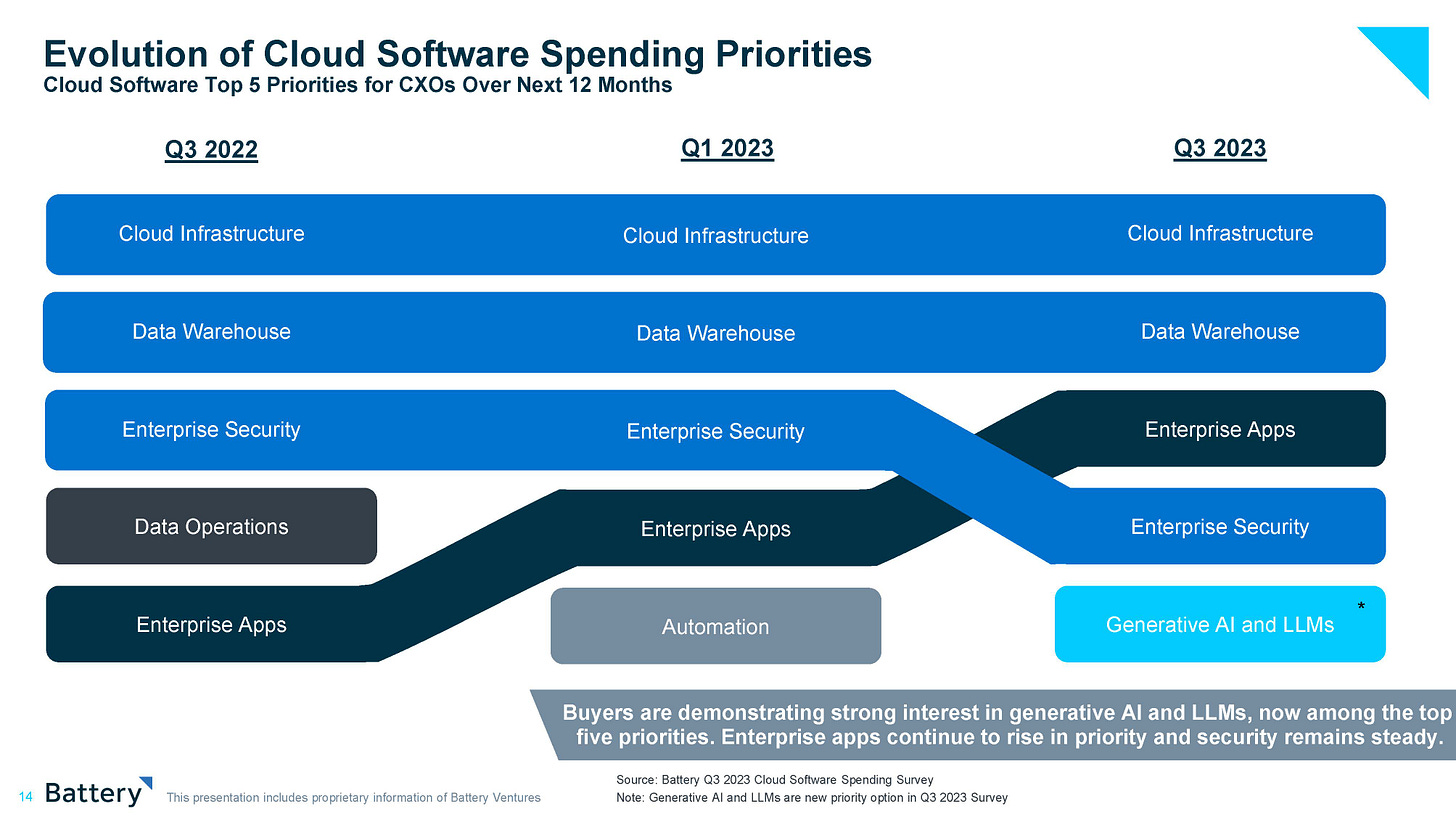

We’re seeing fewer and fewer enterprise-tech buyers remain on the sidelines when it comes to implementing AI and machine learning. The majority of buyers we surveyed expect to keep investing in these tools: 59% plan to increase their AI spending in the next six months and 79% plan to deploy generative AI in the next twelve. In the next two years, 93% of survey respondents expect to move past the experimentation phase with at least one AI tool.

Generative AI isn’t new — its roots date back decades. The modern foundations of generative AI first emerged around 2017 when Google released a whitepaper on “Transformers.” OpenAI and GPT (Generative Pre-Training Transformer) launched in 2018, but the real inflection point was 2023 when ChatGPT-4 was released, spreading the technology across the masses, not just among those with deep technical backgrounds. As many other have said, there is no putting the genie back in the bottle.

What’s driving this accelerating growth in AI adoption? AI technology is maturing into an environment where conditions are finally ripe for its reception. COVID rapidly advanced digital adoption for all industries. We’ve reached a tipping point where most customers engage through digital channels such as digital-shopping apps, patient portals in healthcare and other online tools. The ‘why now’ of AI can be explained by a combination of factors: data availability, widespread consumer engagement with digital products and recent advances in data-science disciplines, including machine learning, explainability tools and the like.

As a result, the value for enterprises of implementing AI tools within, say, a mobile-banking app, is much greater than it would have been a few years ago, because those digital tools are much more widely used and crucial to overall business success.

2. … but the AI market still remains pretty undefined.

With hundreds of thousands of people using ChatGPT and other buzzy AI tools, it’s easy to assume the value of generative AI for enterprises is clear. But the real value lies in the details — “generative AI” is a broad category term covering many models and innovations. Many enterprises are starting with decisions between open-source vs. private models, Bard vs. Llama vs. GPT and whether they should use or block co-pilots. But most enterprises are just starting the AI journey and are more concerned with identifying use cases and business outcomes, rather than leading with tech.

AI’s power resides within the data and the ability to find the right insights and questions to answer. And with spending just ramping up now, many enterprise customers are still in the ‘we think this can be useful, but how?’ phase. What they learn next could shape the market and use cases to come. And it’s hardly a small bet these buyers are making on AI exploration: Our survey respondents plan to deploy approximately $1.5 billion in additional spending on AI/ML in the next six months, including generative AI. This investment will solidify tool chains/stacks that will last well into the future.

3. Enterprises see AI’s potential, but they’re demanding real use cases for it.

From our conversations with enterprise-tech buyers, it’s clear that they are laser-focused on use cases. They don’t want or need to play with the latest tech for its own sake, they want to know how AI can solve a business problem or create a new opportunity.

Enterprise leaders we’ve spoken to are already aware of some key use cases, such as making workers more efficient by automating simple tasks; interacting with customers (i.e., chatbots); analyzing data to generate insights; or summarizing customer or patient relationships.

For example, a bank might look to use AI to help synthesize all the data they have on a single customer from multiple touchpoints, creating a fuller picture of a mortgage applicant who also owns a small business and could find additional banking products, like a business line of credit, useful. A hospital system might use AI to generate patient summaries, so that an orthopedist who sees a patient has a clear picture of all the other interactions that patient has had with their multiple doctors over the past five years. An AI model could also write a plain-language summary of a patient’s health for the patient herself, to ensure better patient understanding and compliance with recommendations

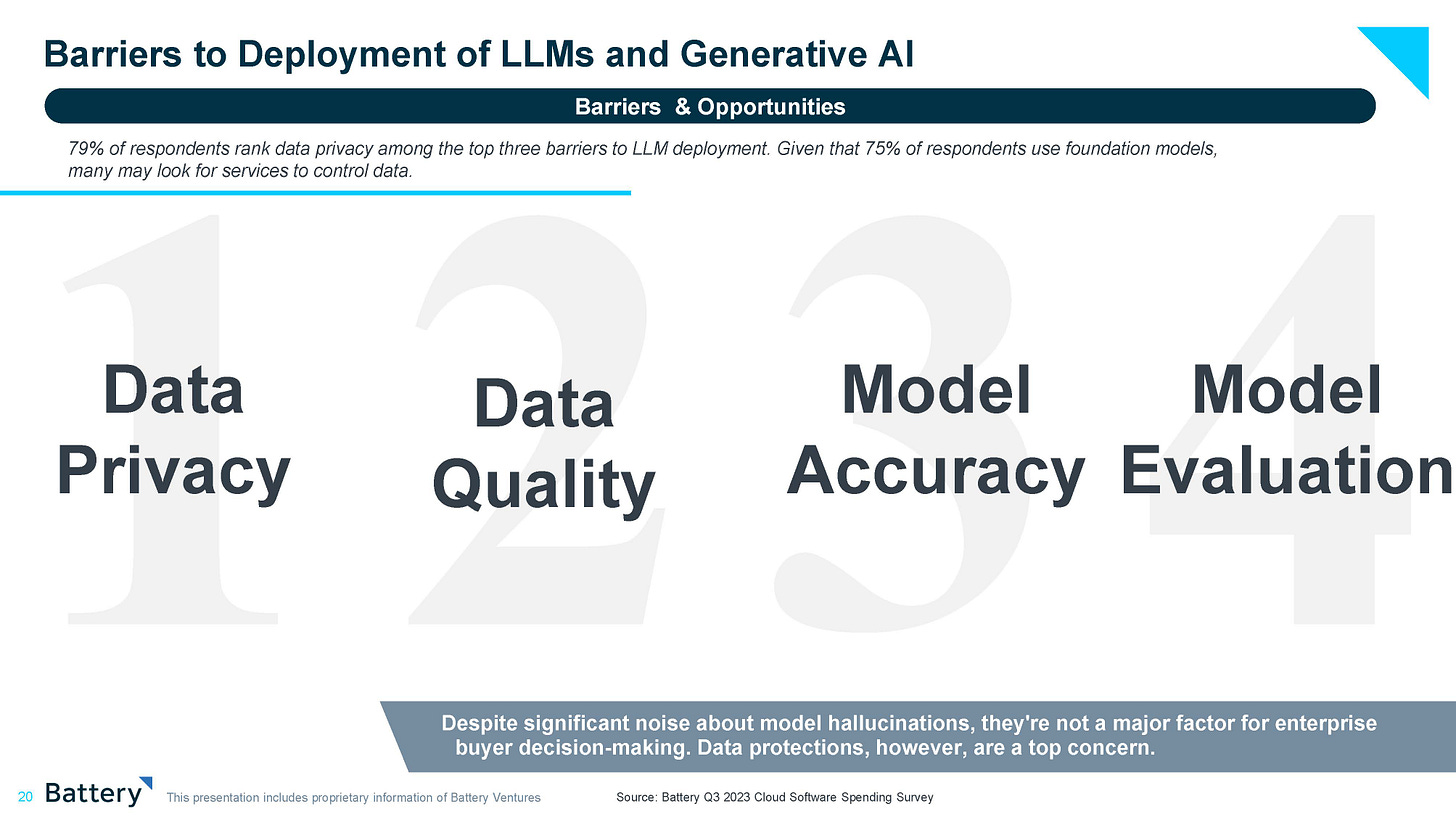

4. For many large enterprise customers, the main concern with AI is data security.

Enterprise customers see the opportunity in using AI to manage data and generate new insights. But many companies can’t and won’t dump their data into an open model, for security reasons — not to mention the complexities of highly regulated industries, or enterprises operating within Europe that may be impacted by changing AI regulations.

Of course, not every data set or use case requires this level of security concern. If a fast-food chain uses a chatbot to take orders, the stakes are relatively low if errors occur. However, financial and healthcare customers (among others) handle highly sensitive data and can’t simply use an off-the-shelf generative-AI model. These businesses will instead look to bring a generative-AI model in-house, train it securely within their walled garden on their data and fine-tune the model for their own use.

5. One huge opportunity in AI: It can help enterprise customers more effectively use the data they already gather.

One top-5 bank we spoke to estimates they’re only using 4% of their customer data today. Software tools for gathering customer data are both robust and ubiquitous. Large enterprise customers don’t need tools to gather more data as much as they need more tools to manage and analyze data for actionable insights. Some enterprise leaders we’ve spoken to are cautiously optimistic that generative AI will finally fulfill the promise of “big data” from years past, and help them create a future of better, more personalized recommendations and customer journeys.

Conclusion

It’s clear from our data and our conversations with buyers that enterprise customers are fully aware of AI’s potential. They recognize they have a data problem: the big data revolution promised a lot, but only partially delivered on that promise. They know that AI could make the difference, and they’re ready to run controlled experiments to unlock AI’s value. Most importantly, these enterprises are prepared to spend on new AI tools—but only if those tools can be customized for their purposes and security needs and designed to solve crucial business problems. AI startups should lead with the business problem their tool solves or the business opportunity it can unlock, not hype up the tech itself.

Contending with generative AI means preparing for a more nuanced, less black-and-white world. The outputs generated by these technologies won't always be a simplistic binary yes or no. As with many previous paradigm-changing solutions, complete certainty may be difficult to attain. However, organizations that have practiced navigating these nuanced areas will be better equipped to have meaningful conversations about how to apply this technology, how to use it effectively, and how to tailor it to their cultural risk tolerance. Waiting for complete certainty may put organizations at a disadvantage.

This evolution is underway and will not be slowed down. Unlocking the value of AI won’t come from a switch flipped sometime in the future — it will entail a long cultural change. If you aren't starting to experiment with AI today, you will be left behind.

The information contained herein is based solely on the opinions of Scott Goering and Evan Witte and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes. The anecdotal examples throughout are intended for an audience of entrepreneurs in their attempt to build their businesses and not recommendations or endorsements of any particular business.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.